What are co-pay and deductibles in insurance policies?: Navigating health insurance can feel overwhelming, especially when terms like co-pay and deductible come up. These are key parts of most insurance policies that determine how much you pay out of pocket for medical care. Understanding them helps you choose the right plan and budget for healthcare costs effectively. In this guide, we’ll break down what co-pays and deductibles mean, how they differ, and why they matter.

istockphoto.com

dreamstime.com

What Is a Deductible?

A deductible is the amount you must pay for covered healthcare services before your insurance plan starts to contribute. Think of it as a threshold – once you reach it, the insurer begins sharing the costs.

- It’s usually an annual amount that resets each year.

- For example, if your deductible is $2,000, you’ll pay the full cost of doctor visits, hospital stays, or prescriptions (up to that limit) out of your own pocket.

- Preventive care, like annual checkups, is often exempt and covered fully without counting toward the deductible.

High-deductible plans often pair with lower monthly premiums, making them popular for healthy individuals who want to save on regular payments.

What Is a Co-Pay?

A co-pay (or copayment) is a fixed amount you pay for a specific service at the time you receive it. It’s predictable and straightforward.

- Common examples: $20 for a primary care visit, $50 for a specialist, or $10 for generic prescriptions.

- Co-pays apply even before you’ve met your deductible in many plans, especially for routine visits.

- They don’t usually count toward your deductible but do contribute to your out-of-pocket maximum.

This setup makes budgeting easier for frequent doctor visits, as you know exactly what you’ll owe upfront.

algatesinsurance.in

instagram.com

Key Differences Between Co-Pay and Deductible

While both are out-of-pocket costs, they work differently:

| Feature | Deductible | Co-Pay |

|---|---|---|

| Amount Type | Fixed annual total | Fixed per service |

| When It Applies | Before insurance pays anything major | At the time of each service |

| Typical Amount | $1,000–$5,000+ per year | $10–$100 per visit or prescription |

| Counts Toward | Out-of-pocket maximum | Out-of-pocket maximum (usually) |

| Predictability | Varies by total spending | Always the same for that service |

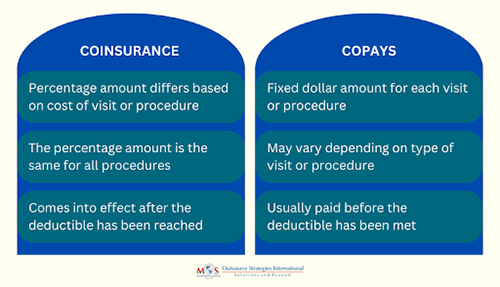

Many plans also include coinsurance, where you pay a percentage (e.g., 20%) of costs after meeting your deductible. This often kicks in for bigger expenses like surgeries.

outsourcestrategies.com

instantpay.in

Real-Life Example

Imagine your plan has a $1,500 deductible and $30 co-pay for doctor visits.

- Early in the year, you see your doctor for a checkup: Pay $30 co-pay (if applicable) or full cost if deductible not met.

- Later, you need surgery costing $10,000: You pay the remaining deductible (say $1,470), then coinsurance (e.g., 20% of the rest), while insurance covers the majority.

Once you hit your out-of-pocket maximum, the plan covers 100% for the rest of the year.

Frequently Asked Questions (FAQ)

Does co-pay count toward my deductible? Usually no – co-pays are separate, though they count toward your annual out-of-pocket max.

Are preventive services affected? No, things like vaccinations or screenings are often fully covered with no co-pay or deductible.

What’s better: high deductible or high co-pay? It depends. High-deductible plans suit those who rarely need care (pair with HSAs for tax benefits). Plans with co-pays are great for families with regular visits.

Can I avoid these costs? Shop plans carefully – some have $0 co-pays for in-network care.

Conclusion

Co-pays and deductibles are designed to share costs between you and your insurer, keeping premiums affordable while encouraging responsible use of healthcare. By grasping these concepts, you’ll feel more confident picking a policy that fits your needs and avoids surprise bills. Always review your plan details or talk to your provider for personalized advice. Staying informed is the best way to protect your health and wallet.